Sheng Siong Group Ltd (SSG) is a Singapore-based investment holding company that is engaged in the supermarket operations, and trading of general and wholesale importers and exports. The Company operates through the provision of supermarket supplies and supermarket operations segment. The Company is a retailer with over 40 supermarket/grocery stores located all across Singapore. The Company’s chain stores are designed to provide customers with various shopping options ranging from an assortment of live, fresh and chilled produce, such as seafood, meat and vegetables to packaged, processed, frozen and/or preserved food products, as well as general merchandise, including toiletries and essential household products. The Company offers over 400 products under approximately 10 brands. The Company’s subsidiaries include Sheng Siong Supermarket Pte. Ltd., CMM Marketing Management Pte. Ltd., Sheng Siong (M) Sdn. Bhd. and Sheng Siong (China) Supermarket Co, Ltd.

In this article I will touch on the quantitative and qualitative aspect of the company outlook with the former being quantitative.

Management

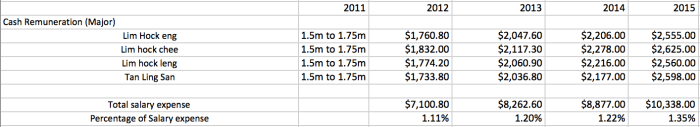

The top few earners in SSG are Lim Hock Eng, Lim Hock Chee, Lim Hock Leng and Tan Ling San. As can be seen from the table below, their earnings increased at a steady rate from 2011 to 2015 with the performance of SSG improving as well. I particularly like the fact that the salary expense hovers below 1.5% of total revenue.

Cash Flow

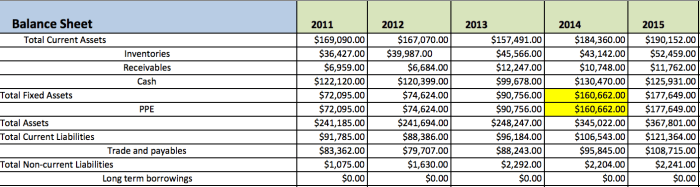

The company has always maintained a steady reserve of cash excluding 2016 where they spent less than $80million on expansion in the Bedok store. This information can be found from SSG’s Investor relations under the announcement of 3Q2016 earnings. It has always been a policy in SSG to distribute at least 90% of its profit after tax as dividends and the company has so far maintained that commitment. Apart from SSG’s cash reserve, the company practically held zero interest-bearing borrowings since 2011, although they did issue additional shares to raise funds in 2014 as detailed in the FY2014 Annual Report.

Profitability

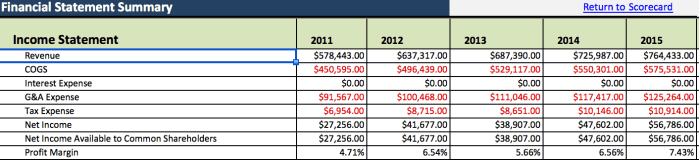

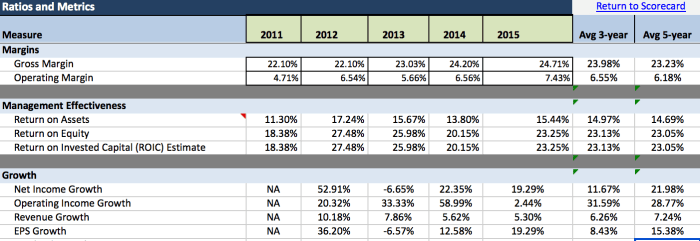

SSG has steadily maintained a profit since 2011 and has been growing since. Besides the increment in profit, SSG has also been improving its profit and gross margin, which is provided below.

Another fact to point out is that since 2011 SSG has actively been looking for opportunities to expand its business. In a nutshell, SSG:

- Open four new outlets at Elias Mall, Teck Whye, Woodlands Industrial Park and Thomson Imperial Court in 2011

- 8 new stores opened in 2012 and clinched the Most Transparent Company Award 2012

- Purchase 6 retail shops space at Junction 9 for $54.9m in 2013 which is expected to be built by mid 2017

- Issuance of 120m new shares in 2014 raising $79m that increased the Market Capitalization to exceed $1bn

- It also did renovations in its Teban Gardens and AMK outlet and signed 2 leases at Bukit Panjang and Punggol of 5,200 and 3,300 sq.ft respectively in 2014

- On the same year 2014, SSG entered into a conditional Joint Venture with LuChen Group to operate supermarkets in Kunming, China with SSG holding a 60% stake amounting to $6m USD in the joint venture

- In 2015, SSG opened 5 new outlets and managed to obtain a license to operate supermarkets in China and entered a lease for retail space of approx. 54,400 sqft in a shopping mall in Kunming that forecasted to commence operations in 4Q2016 though was delayed as mentioned in a recent announcement

- In 2015 it also opened new supermarkets in particularly Yishun Junction 9 (19,000 sqft.), Circuit road (3,500 sqft.), and Upper Boonkeng road (3,000 sqft.

Though a company’s past performance is not a predictor of its future performance, in 2016 SSG has for the first 3 quarters of the year maintained a steady improvement in each quarter.

For the first 3 quarters of 2016, SSG made a 10.78% YoY growth as compared to 2015. Of course, there is no certainty that SSG will post a higher profit in 2016 but the odds of it seem pretty high.

Outlook

In this section I will touch on the qualitative aspect of the company and together with my previous quantitative findings to produce a final conclusion.

Think of the nature of a supermarket. It carries many other brands and sometimes maybe it’s own brand of products. The distinction between a good supermarket and a bad one thus isn’t defined by it’s own brand of products but rather, the coordination of activities. Meaning to say the logistics and the overall experience it gives to customers. People shop at a supermarket not to buy the house brand but other different ones from all over the world. And how SSG stood out amongst its competitors was the strategic location of all its outlets.

With low to middle income people making a great proportion of Singapore’s population, SSG has capitalized on the fact to strategically locate it’s outlets in order to capture these people as customers.

If you’re living at a block with Sheng Shiong market less than 200 metres away, would you travel all the way to somewhere else just to shop at Giant or Fairprice NTUC? Similarly, the same logic applies to Giant or Fairprice NTUC and the interesting part of it is that customers are regulars of the supermarket because that is just the nature of Supermarkets with a good location.

In conclusion, the business outlook for SSG seems to me pretty decent with predictable recurring earnings. After all whether in times of recession or boom people will still have to shop at the supermarket. In regards to valuation of the stock, there have been talks about SSG being overvalued. While I have the same sentiment, I based my decision to buy it on it’s future potential. That is to say, I have no target price to sell and will only execute sell when their earnings deviate from the current trend.

From what I’ve observed, the trend will continue, at least for FY 2016.

The information and analysis provided above are just based on my opinions. My intention is definitely not to recommend the stock but rather to label down my thoughts and process for future references. Please do your own due diligence and refrain from listening to me.