Sembcorp Industries Ltd is a company that engages in the production and supply of utilities services, terminaling and storage of petroleum products and chemicals. The Company’s segments include Utilities, Marine, Urban Development, and Others/Corporate. The Utilities segment offers energy, water, on-site logistics and solid waste management to industrial and municipal customers. The Marine segment focuses principally on providing integrated solutions for the marine and offshore industry. The Urban Development segment owns, develops, markets and manages integrated urban development’s comprising industrial parks, as well as business, commercial and residential space in Asia. Its Others/Corporate segment comprises businesses mainly relating to minting, design and construction activities, offshore engineering and others. The Company offers solutions, including rigs and floaters, repairs and upgrades, offshore platforms and specialized shipbuilding.

The company’s structure and business model seems to be complicated as such, I apologize for any mistakes made and would appreciate for any constructive feedbacks. One of the main reasons for choosing Sembcorp Industries is its position as one of the leading players in the field of energy. The Paris Climate talks had reiterated the importance of renewable energy and the potential danger of carbon emission to our society. With a goal to keep global warming to 2 degrees, the relevance of clean energy stand paramount to the world.

Management

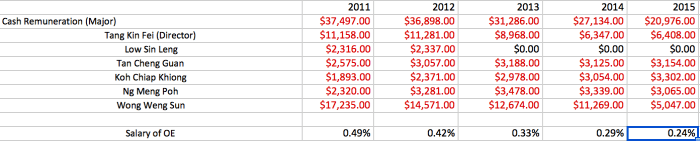

Before I dive onto the financial performance and position of the company, I would like to discuss the management of Sembcorp Industries based on the monetary compensation to senior managements.

These are not all but some of the highly paid management in the company. Particularly from 2014 to 2015, the company has suffered from poor performance in its Marine operations and thus led to the reductions in the Group’s overall profit. Based on the data shown above (No data of 2016), there is indications suggesting that the remuneration of senior management is appropriately decided based on the overall performance of the company. Hence, I hold no objections to purchasing the company.

Financial Performance

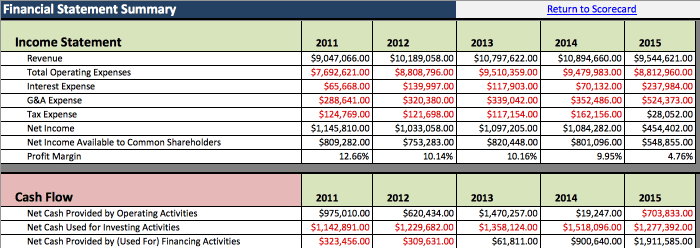

Regarding the financial performance since 2011, the company has done particularly bad in the year 2014 and 2015. This was due in part to the poor performance from the Marine operations.

Such poor performance led me to dig deeper into the reason behind such results. From the picture above, the net cash provided by operating activities fell terribly from 2013 to 2014 and to 2015. The fall from 2013 to 2014 as mentioned in the annual report, was due to the change in working capital for ongoing rig building projects while the fall from 2014 to 2015 was due to the loss in Marine operations. In response, the company made 609 million impairment and provision for rigs, including 329 million for Sete Brasil project and 280 million for possible extended deferments or cancellations. In the CEO interview, it was mentioned that excluding the impairment and provisions and joint venture losses, the Marine business made a net profit of 384 million.

At the same time over this period, the company sees an increase in interest-bearing borrowings. Fixed rate debts decreased from 76% in 2014 to 66% in 2015, which signifies a greater exposure to fluctuations in interest rate risk. On a side note, the company mentioned that it places a great focus in Asia. Utilities PFO (Profit from operations) from Singapore operations decreased 29% to 203.9m due to intense competition in local power market while Utilities PFO from the rest of ASEAN, Australia & India grew 186% to 179m from 62.5m.

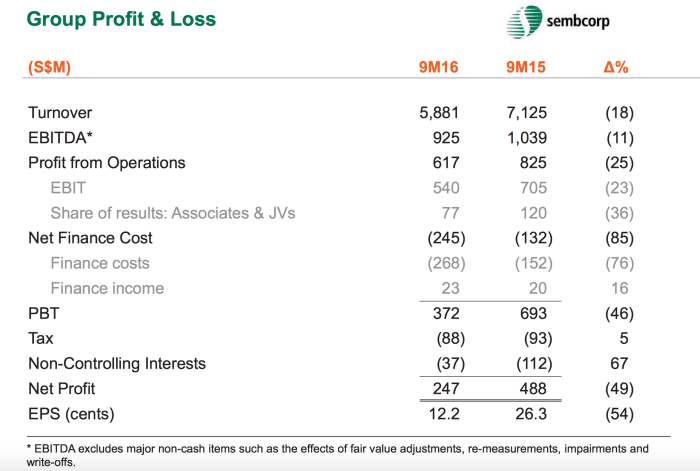

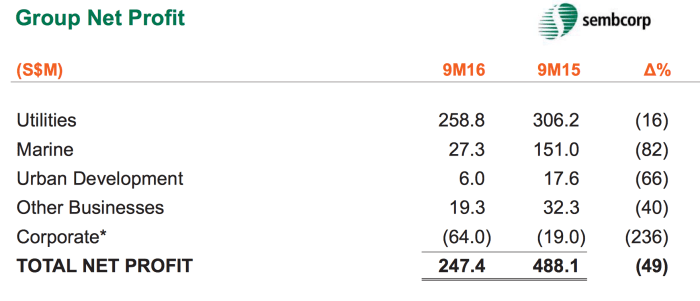

While the poor performance in 2015 seems to be justified, I can only base my judgment of the company’s performance in 2016 based on its 9 months progress. Referring from the table provided, it indicates that all 5 different operations of the company are facing some headwind although not exactly clear if it is due to one off divestment.

Valuation

Based on the recently reported earnings 9M16 of 12.2 cents, I project the final year (2016) EPS to be around 17 cents. With the current risk-free rate of US bonds at 2.323%, and expected dividend yield of 2.5% to 3%, the desired minimum annual return stood around 5%. As such, based on 5-year forecast of EPS as provided, I estimate the stock value after 5 years to be $3.40 with current intrinsic value of $2.67. Currently, the market is trading the stock at $2.73, which gives an estimated margin of safety of around -2.34%.

Conclusion

With uncertainties to the financial performance of 2016, I cannot exactly evaluate the company’s performance in 2016. Nevertheless, if the operations are as mentioned in its recent 9M2016 report, which exclude one off transactions, then the performance of the company seems to be declining.

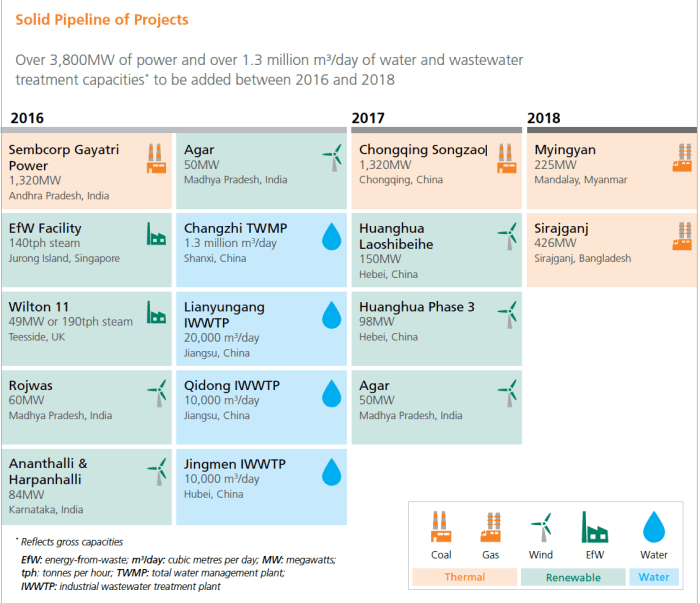

While the quantitative aspect of this analysis provide a negative evaluation of Sembcorp Industries, I strongly believe the relevance of its operations. With uncertainties in the political situations of U.S. and Europe, the company’s focus on Asia will strongly benefit it. On top of that, some operations are currently being tasked to Sembcorp Industries as shown below.

Finally, I would like to end off by saying that this analysis is independently conducted by me and I have no benefits in doing this analysis. My main goal of the analysis is not to recommend people but rather, to gain opinions of different individuals.