A short read at your local newspaper stand and you’ll find that the world economy isn’t doing very well… From negative readings of economic indicators to political conflicts, it seems like the good days are gone. Stock markets around the world are doing badly, and so are the commodities market and the different sectors as shown below.

Following which, it seems like the ideology of quantitative easing to better stimulate the economy has become a trend with central banks from the big markets are joining the bandwagon. China, Europe, Japan and the United States are all believers of this particular approach. But will this approach prove effective? Well only time can tell. In the mean time, this article will provide a very brief economic outlook of the major players in the world.

China

Despite China’s slowing economic growth, therein lies underneath a significant issue that is worrying. The son of Xi Zhongxun a communist revolutionary and a political leader in the People’s Republic of China, Xi Jinping is a hard man who’s keen on eliminating corruption in the governing system. Xi understood how corrupted and incompetent officials would damage the future prospect of China and have sworn to wage a war on corruption of an intensity not seen since the party came to power in 1949. Results have shown that Xi’s approach to anti-corruption is working well. Not all ends well, he has been labeled “Chairman of Everything” because his pursuit of power made him more powerful than any Chinese leader since Mao Zedong. Not only is he the party leader, head of state and commander-in-chief, but also running reform, the security services and the economy. In a nutshell, he has established a collective leadership for himself. In an open letter that appeared in a government-linked news media was calling for Mr Xi to step down and clear his record in office. The president they claimed had accumulated too much power, out casting the Prime Minister Li Keqiang, which they said caused instability in equity and property markets and distorted the role of the media through banning free speech in the country.

In regards to the development of China’s economy, since last year Xi has spoke about the need for “supply-side” reforms, implying that inefficient, debt-laden and overstaffed unproductive state-owned enterprises (SOEs) need restructuring. But his approach has clearly yet to show any progress of competence. Some optimists believes that once Mr Xi cleans up the party, he will be able to turn his attention to economic reforms. But Xi’s pursuit of power has led to problems such as inefficient allocation of human resource for example letting Prime Minister Li Keqiang oversees the country’s economic reform. Such indulgence in power has shown traits of dictatorship. If such a system continues, it would be detrimental to the country as shown in past history of similar governance.

Europe

In light of recent terrorism acts, the topic on free movement of people implied that terrorists could enter Britain by exploiting the system. This prompted the concerns of Britain potentially leaving European Union (EU) due to the increase in migrants. The large amount of migrants according to citizens, burdens taxpayers, drives up welfare spending and worsens the housing crisis. Apart from that, migration steals jobs at the same time suppressing wages to low levels. What would have happen if Brexit really happens?

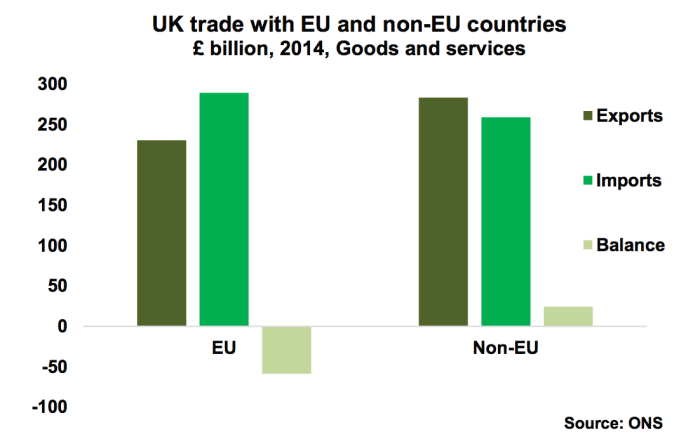

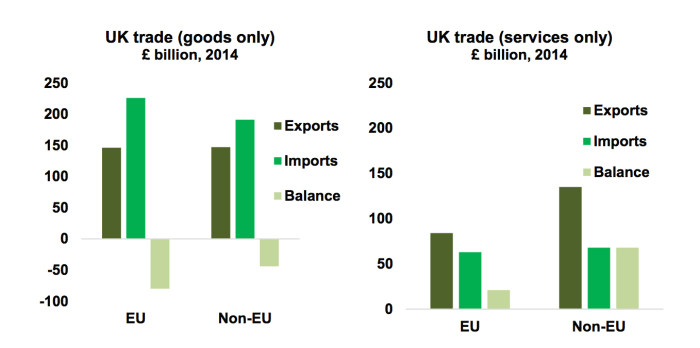

The EU, taken as a whole, is the UK’s major trading partner, accounting for 45% of exports and 53% of imports of goods and services in 2014. Should Brexit takes place, Britain’s access to EU’s single market might be compromised. To be able to continue accessing EU’s market, the EU might impose requirements to Britain to accept free movement of people like its peers Norway and Switzerland. The denial of entry to EU’s market would greatly damage the Britain’s economy and not to mention, its currency as well.

Japan

When Bank of Japan (BoJ) announced the move to monetary easing via negative interest rates; market reaction would expect the currency to weaken. However, market’s reaction has been counter-intuitive, despite recent policy shifts by the European Central Bank (ECB) and BoJ, which saw the Euros and the Yen strengthening. Instead of viewing the easing of monetary policy as a method to balance out the growth of the economy and currency, I strongly urge readers to view monetary easing as an indicator of how uncertain the economy is doing.

Three years after the launch of Abenomics, the Japanese economy seems to be stalling, with growth and inflation both around zero and latest figures showing that industrial production fell by 6.2% in February. Apart from declining demand across majority of commodities sector, Japan faces a serious labor problem as addressed by Prime Minister Shinzo Abe this week. The country’s labor market feeds a range of core problems that include weak wage growth, low productivity and investment. Mr Abe has focus his policies on the topic on Gender Equality, which is a major problem in Japan. He wants to integrate women into the workforce, which is a breakthrough for Japan as Japan has a higher man to woman ratio at the senior positions of corporations.

After Japan’s economic bubble burst in the 90s, companies have increasingly turned to hiring non-regular workers who are easily dismissed in bad times. Initially meant as a cost-effective solution has now turned into a persistent problem in the Japanese labor market. The dual labor market is a big drag on labor productivity due to the high level of protection for permanent employees, which limits the flow of talent and money into prospective companies.

Mr Abe emphasis of policies such as monetary easing to drive corporate profits and pay higher has inadvertently neglected the division of labor in the labor market. To stimulate Japan’s growth rate, reforming the dual labor market has to be of top priority.

United States

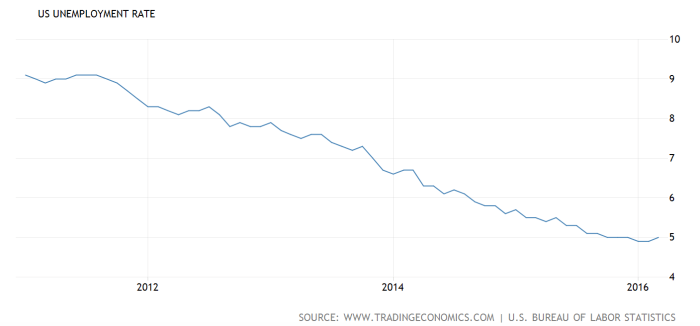

When the Federal Reserve (Feds) announced rate hike for the first time since 2006, it shocked investors, which caused the stock market to plunge. Fast forward, the dollar currency has risen by almost 20% since the start of July 2014. Against the other major currencies, the dollar is rising against the Yen, Euros and Yuan. The U.S seems to be doing relatively well with unemployment rate low, higher than expected (1%) GDP growth of 1.4% on quarter in the last three months of 2015 and moderate inflation rate of 1% year-on-year in February 2016 down from 1.4% increase in the previous month due to lower energy cost.

Against overseas competition, the strengthened greenback has caused prices of American goods to rise, which could affect American exporters. In those with floating currencies, debt-servicing costs jumped for companies that took loans in dollars. Apart from U.S moderate growth, political discussions will stay for the year of 2016 in regards to the election that will be held in November 2016. With different approach to policy decisions, it’ll be a hefty fight between Hillary Clinton, Bernie Sanders, Ted Cruz, John Kasich and Donald Trump.

In summary, it would seem that globally, the economy seems to be doing relatively unstable with political conflicts, the fights against terrorism and declining demand for commodities. As more central banks around the world join in the bandwagon of monetary easing, foreign exchange investors have to take extra precaution in trading as a currency war might erupt at any point in time. The fight for anti-corruption and money laundering by Mr Xi’s anti-graft campaign and the revelation of the Panama Papers though uncertain of how it might affect the economy, it definitely weighs a punch in the creation of tighter regulations and more anti money laundering law.