The shift from bonds to stocks investing in the past century has highlighted the importance in the ability to analyze companies. In the final section of Graham’s Security Analysis the author focused on the topic of stock investing. As such, this article will be solely on the analysis of companies. Once again let me reemphasize, whatever that will be stated is 100% from the text of Ben Graham and David Dodd Security Analysis and the purpose of this post is to serve as a reminder and summary of this very particular book. Please be noted that whatever stated is base on the American market and therefore, some of the financial jargons may be unfamiliar to some of you.

- The difference between what a company pays for an acquisition and the acquired company’s book value goes on the balance sheet as an intangible asset called “goodwill”. These charges reduced net income but did not take any cash out of the business.

- A company selling at less than seven times its free cash flow is an attractive valuation, akin to buying a bond yielding 14% with a decent chance that coupon payments would rise over time

- How management deploys cash and whether those decisions enhance shareholder value is another important aspect of evaluating free cash flow

- The cash doesn’t do the shareholder any good unless management makes smart investments with it, or returns it to its owners via dividends or share buybacks

- American Can was speculative for three reasons:

- It paid no dividend

- Its earnings were small and irregular

- The issue was “watered” (a substantial part of its stated value represented no actual investment in the business) Pg. 351

- The common-stock investor also, wanted a stable business and one showing an adequate margin of earnings over dividend requirements

- Investment of common stocks WAS based on the threefold concept of:

- A suitable and established dividend return

- A stable and adequate earnings record

- A satisfactory backing of tangible assets

- The past earnings were significant only to the extent that they indicated what changes in the earnings were likely to take place n the future

- Since no relationship apparently existed between assets and earning power, the asset value was entirely devoid of importance

- There are several reasons why we cannot be sure that a trend of profits shown in the past will continue in the future In the broad economic sense, there is the law of diminishing returns and of increasing competition which must finally flatten out any sharply upward curve growth

- Most successful companies of the past are found to have pursued a well-defined life cycle, consisting first of a series of struggles and setbacks; second, of a halcyon period of prosperity and persistent growth; which in turn passes over into a final phase of super maturity (characterized by a slackening of expansion and perhaps an actual loss of leadership or even profitability)

- Whatever benefits a business benefits its owners, provided the benefit is not conferred upon the corporation at the expense of the stockholders

- From the dividend standpoint, it is clear that in both of these examples the decision to retain large amounts of earnings, instead of paying them out to stockholders, was due in part to the desire to eliminate intangible items from the asset accounts Pg. 384

- An extra-liberal dividend policy cannot compensate for inadequate earnings, since with such a showing the dividend rate must necessarily be undependable

- The dividend ratio is the ratio of the dividend paid to the market price

- The earnings ratio is the ratio of the annual earnings to the market price (e.g. a stock earning $6 and selling at $50 shows an earning yield of 12%)

- If the investor makes a small concession in dividend yield below the standard, he is entitled to demand a more than corresponding increase in the earning power above standard

- Taking away value increases value. The more the stockholder subtracts in dividends from the capital and surplus fund the larger value he places upon what is left

- Frequently, the stockholders derive much greater benefits from dividend payments than from additions to surplus. This happens because either:

- The reinvested profits fail to add proportionately to the earning power

- They are not true “profits” at all but reserves that had to be retained merely to protect the business. In this majority of cases the market’s disposition to emphasize the dividend and to ignore the additions to surplus turns out to be sound

- Evaluate investment opportunity based on the predictability of the business and a dispassionate calculation of its expected rate of return

- Look at the average earnings, so as not to be misled by a recent year of abnormal performance

- Earnings must be understood in the absence of nonrecurring items

- Reduction in the market value of securities should be considered as a nonrecurring item in the same way as losses from the sale of such securities

- Sale of marketable securities: Prior to 1930 most of the companies reported profits from the sale of securities as part of their regular income, but they showed the appreciation on unsold securities in the form of a memorandum or footnote to the balance sheet Pg. 422

- The following example illustrates a whole set of practices that constitute perhaps the most vicious type of accounting manipulation:

This consists in brief, of taking sums out of surplus (or even capital) and then reporting these same sums as income

This consists in brief, of taking sums out of surplus (or even capital) and then reporting these same sums as income

Hudson Motor Car Company charged against surplus instead of income the following items during 1930-1931:

- The effect of these accounting practices is to relieve the reported earnings of expenditures that most companies charge currently there against and that in any event should be charged against earnings in instalments over a short period of years

- The charging of current advertising expense to the good-will account is inadmissible under all canons of sound accounting. To do so without any disclosure to the stockholders is still more discreditable Pg. 436

- In passing judgment on the inclusion of leasehold appreciation in the current earnings of United Cigar stores, a number of considerations might be bore in mind: Pg. 439

- Leaseholds are essentially as much a liability as they are assets. They are an obligation to pay rent for premises occupied. Ironically enough, these very leaseholds of United Cigar eventually plunged into bankruptcy

- Assuming leaseholds may acquire a capital value to the occupant, such value is highly intangible, and its contrary to accounting principles to mark up above actual cost the value of such intangibles in a balance sheet

- If the value of any capital asset is to be marked up, such enhancement must be credited to Capital Surplus (Amount which firm raises in excess of par value of shares). By no stretch of the imagination can i be considered as income

- The $20,000 appreciation of the United Cigar leases took place prior to May 1924, but it was treated as income in subsequent years. There was thus no connection between the $2,347,000 appreciation included in the profits of 1928 and the operations or developments that year

- If the leaseholds had really increased in value, the effect should be visible in larger earnings realized from these favorable locations. Any other recognition given this enhancement would mean counting the same value twice. In fact, however, allowing for extensions of the business financed by additional capitalization, the per-share earnings of United Cigar showed no advancing trend

- Whatever value is given to leaseholds must be amortized over the life of the lease. If the United Cigar investors were paying a high price for the shares because of earnings produced by these valuable leases, then they should deduct from earnings an allowance to write off this capital value by the time it disappears through the expiration of the leases.

- Distorted earnings through Parent-Subsidiary R/S: E.g In 1925 Western Pacific Railroad corporation paid dividends of $7.56 upon its preferred and $5 upon its common. Its income account showed earnings slightly exceeding the dividends paid. These earnings consisted almost entirely of dividends aggregating $4,450,000 received from its operating subsidiary, the Western Pacific Railroad Company. The year’s earnings of the railroad itself however were only $2,450,000. Furthermore its accumulated surplus was insufficient to permit the larger dividend that the parent company desired to report as its income for the year. To achieve this end, the parent company went to great length to donate $1,500,000 to the operating company and immediately took the same money back as a dividend from its subsidiary. In this devious fashion it was able to report $5 “earned” upon its common stock when in fact the applicable earnings was only about $2 per share

- Subsidiary losses are to be deducted in every analysis

- If the amount involved is significant, the analyst should investigate whether or not the losses may be subject to early termination

- If the result of this examination is favorable, the analyst may consider all or part of the subsidiary’s loss at the equivalent of a nonrecurring item

- Perhaps the most striking phenomenon in the field of depreciation accounting is the recent marking down of the fixed assets, not in the interests of conservatism but with the precisely opposite intent of making a better earnings exhibit and thereby increasing the apparent value of the shares

- It is difficult to avoid the conclusion, however that the capital investments in additional plants were actually being charged against the profits (or operating expense) and that the real earnings were in all probability much larger than those reported to the public

- On mining companies, because of the artificial base used in these computations, many companies have omitted the depletion charge from their reports to stockholders

- In the case of oil company, the various headings under which write-offs must be included:

- Depreciation of tangible assets

- Depletion of oil and gas reserves, based upon the cost of the leases

- Unprofitable leases written off. Part of the acquisitions and exploration will always prove totally valueless and must be charged against the revenue from the productive leases

- Intangible drilling costs. These are either written off at one time as equivalent to an operating expense, or amortized over the life of the well

- We think that loss on property retired (in excess of depreciation already occurred) should be charged against the year’s earnings, rather than against surplus as is done by most companies. The reason is that property retirements are likely to be a normal and recurrent factor in the business of a large, integrated oil company, instead of happening only sporadically as in other lines

- Depletion of oil reserves: The proper theoretical principle here is that the analyst should allow for depletion on the basis at which the oil reserves are valued in the market

- The concept of earning power (Pg. 473) has a definite and important place in investment theory. It combines a statement of actual earnings, shown over a period of years, with a reasonable expectation that these will be approximated in the future, unless extraordinary conditions supervene

- Quantitative data are useful only to the extent that they are supported by a qualitative survey of the enterprise

- Current earnings should not be the primary basis of appraisal. The market level of common stocks is governed more by their current earnings than by their long-term average. This fact accounts in good part for the wide fluctuations in common-stock prices, which largely parallel the changes in the earnings between good years and bad. Obviously the stock market is quite irrational in thus varying its valuation of a company proportionately with the temporary changes in its reported profits. A private business might easily earn twice as much in boom year as in poor times, but its owner would never think of correspondingly marking up or down the value of his capital investment

- When share price faces a downward trend, analyst must conduct a qualitative study of the company’s situation and prospects to forming an opinion whether at some price, relatively low, the issue may not be a bargain despite its declining earnings trend

- When an average is taken over a period that includes a number of deficits, some question must arise as to whether or not the figure is really indicative of the earning power. This point is of considerable importance in view of the prevalence of deficits during the depression of the 1930s Pg. 481

- Analysis of the future should be penetrating rather than prophetic: g. When Intertype Corporation was selling at $8 per share in March-July 1939. This old established company was one of the leaders in a relatively small industry. Its recent earnings had not been favorable, nor did there seem to be any particular reason for optimistic expectations as to the near term outlook. The analyst however, could not fail to be impressed by the balance sheet, which showed net current assets available for the stock amounting to close to $20 per share. Pg. 483. This type of reasoning, it will be noted, lays emphasis not upon an accurate prediction of future trends but rather on reaching the general conclusion that the company will continue to do business pretty much as before

- The inference that rapidly rising profits in previous years meant much larger profits in the future was thus especially fallacious in this case, because by the nature of the business a peak of popularity was likely to be reached at some not distant point, after which a substantial falling off would be inevitable

- The four elements to be considered in mining companies: Pg. 487

- Life of the mine

- Annual output

- Production costs (Affects a company’s profit greatly, to be look into thoroughly)

- Selling price

- The analyst would have to allow for these developments in his calculations, by taking a cautious view of future copper prices

- His fundamental basis of appraisal must be an intelligent and conservative estimate of the future earning power. We would suggest that about 20 times average earnings is as high a price as can be paid in an investment purchase of a common stock. It should be pointed out that if 20 times average earnings is taken as the upper limit of price for an investment purchase, then ordinarily the price paid should be substantially less than this maximum. This suggests that about 12 or 12.5 times average earnings may be suitable for the typical case of a company with neutral prospects.

- The companies analyzed in Group B are obviously speculative, because of the great instability of their earnings records. They show varying relationships of market price to average earnings, maximum earnings, and asset values Pg. 503

- The common stocks shown in Group C are examples of which meet specific and quantitative tests of investment quality. Pg. 503

- The earnings have been reasonably stable, allowing for the tremendous fluctuations in business conditions during the ten-year period

- The average earnings bear a satisfactory ratio to market price

- The financial set-up is sufficiently conservative and the working capital position is strong

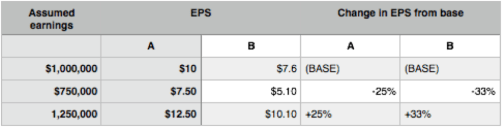

- Adjustment B assumes conversion of the $15,000,000 of convertible 5s, issued in 1934, thus increasing the earnings by the amount of the interest charges but also increasing the common-stock issue by 750,000 shares.

- The intrinsic value of a common stock preceded by convertible securities, or subject to dilution through the exercise of stock options or through participating privileges enjoyed by other security holders, cannot reasonably be appraised at a higher figure than would be justified if all such privileges were exercised in full

- Can the value of an enterprise be altered through arbitrary variations in capital structure? Pg. 508

- If B shares were worth 12 times their earnings, A shares would be worth more than this multiple because they have no debt ahead of them. The risk is therefore smaller while on the other hand, it is equally true that B shares will be more responsive to an increase in earnings.

- Part of A’s stock is at bottom equivalent to B’s bonds and should in theory be valued on the same basis i.e. 4%. The remainder of A should then be valued at 12 times earnings. This theoretical reasoning gives us a combined value of $15,000,000 an average 6.33% basis for the two components of A which is the same as that of B’s bond and stocks altogether. But this $15,000,000 value for A would not be realized in practice. Because the common-stock buyer will rarely recognize the existence of a “bond component” in a common-stock issue and in any event, not wanting such a bond component, he is unwilling to pay extra for it. The capitalization arrangement of B is preferable to A assuming that in both cases the $6,000,000 bond issue would constitute a sound investment. (Provided a working capital of not less than $6,000,000)

- If B shares were worth 12 times their earnings, A shares would be worth more than this multiple because they have no debt ahead of them. The risk is therefore smaller while on the other hand, it is equally true that B shares will be more responsive to an increase in earnings.

- The optimum capitalization structure for any enterprise includes senior securities to the extent that they may safely be issued and bought for investment

- A 25% increase in the earnings of C (from 1,000,000 to 1,250,000) will mean about a 50% increase in the EPS.

- When a company issues bonds, the percentage of capital that comes from stock goes down because there is a new category

- E.g. Company A has mix of stocks and bonds (50-50) while B has more stocks than bonds (60-40). Due to the capitalization structure, A’s earnings should be growing at a higher rate than of B due to the fact that they have fewer shares of common stock outstanding than B

- Factor of Leverage in Speculative Cap Structure: Pg. 514

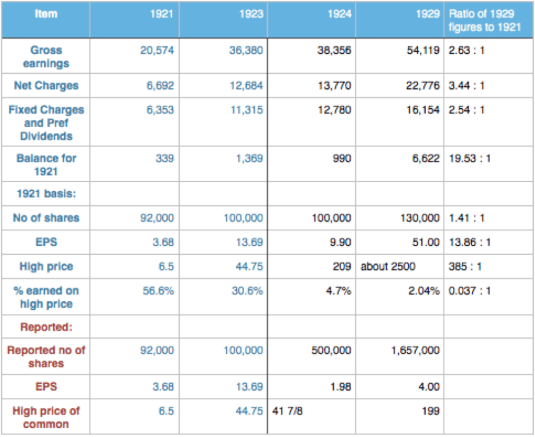

- The above presents a fabulous picture of enhancement in value, due to the influence of a highly speculative capitalization structure. While the market value of the common shares was increasing some 400-fold, the gross earnings had expanded to only 2.6 times the earlier figure. The tremendously disproportionate rise in the common stock was due to the following elements, in order of importance:

- A much higher valuation placed upon the per-share earnings of this issue. In 1921 the company’s capitalization was recognized as top-heavy; its bonds sold at a low price, and the earnings per share of common were not taken seriously, especially since no dividends were being paid on the second preferred. In 1929 the general enthusiasm for public-utility shares resulted in a price for the common issue of nearly 50 times its highest recorded earnings.

- The speculative capitalization structure allowed the common stock to gain an enormous advantage from the expansion of the company’s properties and earnings. Nearly all the additional funds needed were raised by the sale of senior securities. It will be observed that whereas the gross revenues increased about 160% FROM 1921 TO 1929, the balance per share of old common stock grew 14-fold during the same period

- The margin of profit improved during these years as shown by the higher ratio of net to gross. The speculative capital structure greatly accentuated the benefit to the common stock from the additional net profits derived

- Speculatively capitalized enterprises, are marked by relatively large amount of senior securities and a comparatively small issue of common stock

- The speculative or marginal position may arise from any cause that reduces the percentage of gross available for the common to a subnormal figure and that therefore serves to create a subnormal value for the common stock in relation to the volume of business Pg. 525

- Large output vs. low operating cost:

- The foregoing table indicates that a rise in the price of copper from 10 to 13 cents would increase the

- Look out for special earnings derived from operations not in the nature of the company’s one (E.g. Glen Alden Coal Company earning more on bonds held than its own operations)

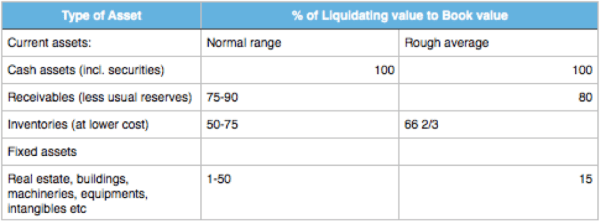

- The book value per share is found by adding up all the tangible assets, subtracting all liabilities and stock issues and then dividing by the number of shares. – (Common stock + surplus items – Intangibles) / Number of shares outstanding)

- Current-Asset value and Cash-asset value (Look at Pg.. 553 for example)

- Those invested in GE in 1929-1930 were paying on the basis of about $2.5 billion for the company of which over two billions represented a premium above the money actually invested in the business. Pg. 556

- The current-asset value is generally a rough index of the liquidating value

- The phenomenon of many stocks selling below their liquidating value is illogical. It means that either:

- Error in judgment of the stock market

- Error in the policies of the company’s management

- Attitude of the stockholders toward their property

- Liquidating value to book value

- Acid test: requires current assets exclusive of inventories be at least equal to current liabilities

- Speculators buying the American Rolling Mill company (1933) because of improvement in the steel industry failed to consider the fact that, in order to refund the notes in the poor market than existing for new capital issues, a very attractive conversion privilege would have to be offered

- It is not dangerous if either the current-asset position is so strong that the loans could readily be taken care of as current liabilities or the earning power is so large and dependable as to make refinancing a simple problem

- Discrepancy between earnings reported and actual (See example on page 599)

- The fact that the company’s working capital decreased by $3,192,000 despite receipt of $6,582,000 from the sale of additional stock, is further evidence that instead of there being a surplus above dividends as reported, the company actually lost money before dividends during these ten years

- Taking losses on inventories may strengthen financial position. It is obvious that losses that are represented solely by a decline in the inventory account are not so serious as those which must be financed by an increase in current liabilities

- If the shrinkage in the inventory exceeds the losses, so that there is an actual increase in cash or reduction in payables, it may then be proper to say – that the company’s financial position has been strengthened even though it has been suffering loses (See Page 602 for example)

- Profit from Inventory Inflation: In 1919 the profits of industrial companies were very large; in 1920 the reported earnings were irregular but in the aggregate quite substantial. Yet the gains shown in these two years were in many cases the result of inventory inflation i.e. a huge and speculative advance in commodity prices. See Page 606 for example

- Viewing the picture from another angle (Page 609), we note that in the thirty years the actual investment in US Steel Corporation was more than doubled and its productive capacity was increased threefold. Yet the average annual production was only 27% higher, and the average annual earnings before interest charges were only 12% higher, in 1923-1932 than in 1903-1912.

- This analysis would serve to ask:

- If since the end of the war, steel production has been transformed from a reasonably prosperous into a relatively unprofitable industry

- If this transformation is due in good part to excessive reinvestment of earnings in additional plant, thus creating a condition of overcapacity with resultant reduction in the margin of profit

- Holding companies can overstate their apparent earning power by valuing at an unduly high price the stock dividends they receive from subsidiaries or by including in their income profits made from the sale of stock of subsidiary companies

- Analysis on Railroad companies (Page 655)

- A speculatively capitalized road will show a large ratio of net deductions to gross and (ordinarily) a small ratio of common stock at market value to gross

- Analysis on Public-Utility companies (Page 661)

- The balance-sheet computations do not have primary significance unless they indicate either definite financial weakness or a substantial excess of current-asset value over the market price

- The less homogeneous the group the more attention must be paid to the qualitative factors in making comparison