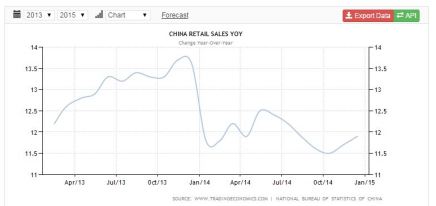

When President Xi Jinping assumed the role as president of the People’s Republic of China on March 2013, he vowed to transform China’s corrupted situation. At that point many people doubted his conviction to change China. To date, it seemed like Mr Xi is one step closer to his objective. From the period when Mr Xi assumed Presidential role till now, many corrupted wealthy has been captured. People such as retired senior leader of the CPP Zhou Yongkang, former politician Bo Xilai and Zhang Kunsheng. Though corruption is bad, it seemed that China’s economy is driven by it and without it, growth is slowing down. Retail sales has fell since the anti-corruption drive as shown below and on the 13th Feb 2015, it was reported that “Gold demand fell for a third year on a slump in purchases from China, costing the country its place as the world’s biggest buyer.”

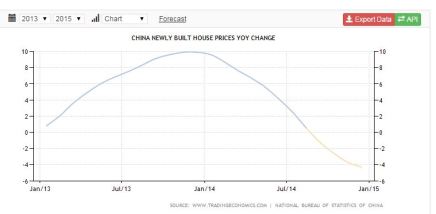

Apart from a faltering consumer spending, China’s property bubble (as shown below) seemed like it is going to burst anytime soon. It is debatable whether a replica of the United States housing bubble crisis would happen again and if it did it could severely cripple China’s economy as a credit crisis might follow.

Already, there has been a concern for the Chinese property sector as Chinese property developer Kaisa defaulted on a HK $400 million loan with HSBC last month. Kaisa’s problems are a concern for China’s real estate industry as offshore investors has been buying Chinese property debt where they are deeply subordinated to onshore lenders, who would have priority over any assets in the event of a default.

Due to excessive regulation and bureaucratic intervention, many Chinese banks only provide loans to state-owned enterprises and other politically favored companies. This caused a surge in the shadow banking scene which remained a real problem for the Chinese economy. Because these shadow banks are not subjected to traditional bank regulation, they cannot borrow in an emergency from the People’s Bank of China (equivalent of the Fed). The problems arise when investors become skeptical about the value of those long-term assets (that they borrowed from the shadow banks to invest) and withdraw their funds at once. As a result, to repay these investors, shadow banks are forced to sell the assets. The sales run reduces the value of those assets forcing other shadow banking entities with similar assets to sell thereby creating a domino-effect. Such uncertainties still loom over the Chinese economy.

Lastly, there has been an over investment on fixed assets. Over the past two decades, Beijing has relied on building roads, power grids and other fixed assets in order to stimulate expansion of the economy. However, this method of building the economy leads to diminishing returns over time thus not a justified reflection on the well-being of the economy. To paint a bigger picture, China is now at a struggle between its anti-graft campaign and stimulating domestic consumption to re-balance the economy as returns on fixed asset investments were declining.

In conclusion, the Chinese economy seems to be filled with uncertainties in the air. While China has been offering monetary aid to countries around the world such as Venezuela and Russia, it shouldn’t be reflected as good progress until its domestic uncertainties clear up. In addition, I feel the lack of social capital in China hinders its economy too. To transform into a developed nation, China should enforce on protection on innovations to stimulate fair competition among businesses.